Artificial Intelligence in Fraud Detection

In today’s digital age, the increasing reliance on technology has made our lives easier in many ways, but it has also opened up new opportunities for criminals to exploit vulnerabilities and commit fraud. Fraudulent activities, such as identity theft, credit card scams, and others, pose significant risks to individuals and businesses alike. However, the same technology that facilitates these crimes can also be harnessed to combat them. Enter Artificial Intelligence (AI), a powerful tool in the fight against fraud.

Understanding Fraud Detection with AI:

AI technologies, such as machine learning and natural language processing (NLP), are revolutionizing fraud detection. These cutting-edge algorithms can analyze vast datasets and recognize patterns that distinguish between legitimate and fraudulent transactions. By continuously learning from historical data, AI stays updated with the latest fraud tactics, enabling it to proactively detect new and emerging threats.

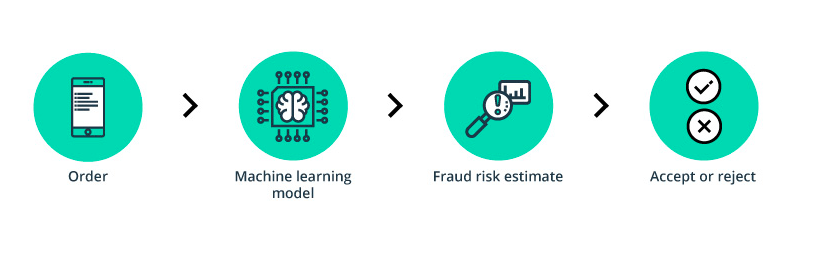

How AI Detects Fraud:

Pattern Recognition: AI-powered fraud detection systems analyze vast historical datasets containing legitimate and fraudulent transactions. By doing so, the algorithms learn to recognize specific patterns associated with fraud. These patterns could be as subtle as the time of day when most fraudulent transactions occur, the typical purchase amounts for compromised credit cards, or the geographic locations from which fraudulent logins originate.

Anomaly Detection: AI establishes baseline behavior for individual users or transaction types based on historical data. It then compares real-time activities against these established norms. If there are deviations from these established patterns, AI raises an alert. For example, if a user typically logs in from the same location but suddenly attempts to access their account from a different country, AI may consider this as an anomaly.

Real-time Analysis: AI systems process transactions in real-time, allowing for immediate detection of suspicious behavior. For instance, if AI detects a credit card transaction that appears to be legitimate but occurs in a high-risk location and exceeds the user’s typical spending limit, it can halt the transaction and notify the user to verify the purchase.

Natural Language Processing (NLP): AI’s application of Natural Language Processing (NLP) extends its capabilities beyond structured data. It can process and analyze unstructured data, such as emails, social media posts, or text messages, to detect signs of fraudulent activities. For instance, AI can analyze customer support interactions and identify phishing attempts disguised as legitimate inquiries or detect malicious links shared on social media platforms.

By combining pattern recognition, anomaly detection, real-time analysis, and NLP, AI-powered fraud detection systems create a multi-layered approach to identify and prevent fraudulent activities effectively. The continuous learning aspect ensures that the algorithms remain up-to-date and adaptive, enabling them to offer a proactive defense against the evolving landscape of fraud. With AI at the forefront of fraud detection efforts, individuals and businesses can confidently navigate the digital world, knowing that their financial transactions and sensitive information are safeguarded against potential threats.

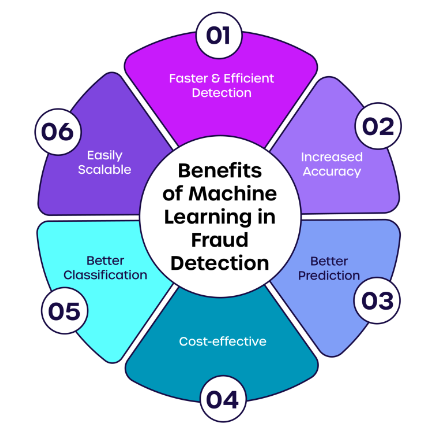

The Advantages of AI in Fraud Detection:

Accuracy: AI’s ability to analyze vast amounts of data with speed and precision ensures a higher accuracy rate in detecting fraudulent activities. By identifying subtle patterns and anomalies, AI minimizes false positives, reducing unnecessary inconvenience for legitimate users.

Continuous Learning: AI algorithms excel at learning from new data and adjusting their models accordingly. As they analyze more transactions and patterns, they become more adept at recognizing and responding to evolving fraud tactics. This ongoing learning process enhances the system’s effectiveness over time.

Cost-Effectiveness: Implementing AI-powered fraud detection systems can be cost-effective for businesses. By automating a significant portion of the detection process, companies can reduce the need for extensive manual reviews and dedicate resources to other critical tasks.

Quick Response: Real-time analysis enables AI to identify suspicious activities as they occur. This swift response allows for immediate intervention to prevent fraudulent transactions, protecting individuals and businesses from financial losses and potential damages to their reputation.

The multi-layered approach of AI-powered fraud detection, combining pattern recognition, anomaly detection, real-time analysis, and NLP, forms a formidable defense against fraudulent activities. AI’s continuous learning ensures that these systems remain agile and responsive to emerging threats, reducing the risk of successful fraud attempts. With AI safeguarding financial transactions and sensitive information, individuals and businesses can confidently embrace the digital world, knowing that their security is fortified against potential threats.

Conclusion:

Artificial Intelligence has revolutionized fraud detection by leveraging machine learning, anomaly detection, and natural language processing capabilities. Through pattern recognition and real-time analysis, AI can proactively detect and prevent fraudulent activities, safeguarding our finances and personal information. Embracing AI in fraud detection is a proactive step towards creating a safer digital landscape, protecting individuals, and fortifying businesses against the ever-evolving threats posed by fraud. As technology progresses, addressing ethical considerations and refining AI models are pivotal to ensuring reliable, fair, and secure fraud detection systems. By staying one step ahead with AI, we can reinforce our defense against fraud and enhance our confidence in the digital realm.